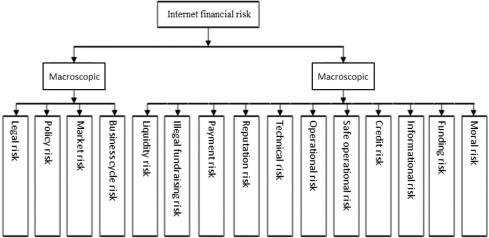

Categories

Network financial risks can be divided into two categories: technical risks based on network information technology and business risks based on network financial business characteristics.

1. Network financial technology risks

(1) Security risks. The business of online finance and a large amount of risk control work are all completed by computer programs and software systems. Therefore, the technical and managerial security of electronic information systems has become the most important technical risk in the operation of online finance. This risk comes from uncertain factors such as computer system downtime and disk array destruction, as well as factors such as digital attacks outside the network and computer virus damage. According to surveys of different industries in developed countries, system downtime has caused the greatest loss to the financial industry. The energy of online hackers’ attack activities is increasing at a rate of 10 times a year. They can use any loopholes and flaws on the Internet to illegally enter the host, steal information, send fake e-mails, etc. Computer network viruses can spread and spread through the network, and the spreading speed is dozens of times that of a single computer. Once a program is infected, the entire machine and the entire network are quickly infected, which is extremely destructive. In traditional finance, security risks may only bring partial losses, but in online finance, security risks can cause the paralysis of the entire network, which is a systemic risk.

(2) Technology selection risk. The development of online financial services must be supported by a mature technical solution. There is a risk of making mistakes in technology choices. This risk comes from the possibility of information transmission interruption or speed reduction caused by poor compatibility between the selected technical system and the client terminal software, and also from the selection of technical solutions eliminated by technological changes, resulting in relatively backward technology and outdated networks. Situation, leading to huge loss of technology and business opportunities. For traditional finance, the wrong choice of technology only leads to a slowdown in business processes and an increase in business processing costs, but for online financial institutions, it may lose all the market or even the basis for survival.

2. Business risk

(1) Credit risk. This refers to the risk of online financial traders not fully fulfilling their obligations on the expiry date of the contract. The online financial service method has the characteristics of virtuality, that is, both the online financial business and service institutions have obvious virtuality. The application of network information technology in the financial industry can realize the establishment of network financial institutions such as network banks on the Internet. For example, the American Security First Network Bank is a typical network bank. Virtualized financial institutions can use virtual reality information technology to add virtual branches or business outlets to engage in virtualized financial services. All business activities in online finance, such as the transmission of transaction information, payment and settlement, etc., are carried out in a virtual world composed of electronic information.

Compared with traditional finance, the importance of the physical structure and architecture of financial institutions is greatly reduced. The virtual nature of the online financial service method prevents the transaction and payment parties from meeting each other, but only contacts each other through the Internet. This makes it more difficult to verify the identity of the transaction and the authenticity of the transaction, and increases the identity of the transaction. The asymmetry of information in confirmation and credit evaluation has increased credit risk. For our country, the credit risk in online finance not only comes from the fictitiousness of service methods, but also the possibility of default caused by the imperfect social credit system. Therefore, the credit risk in the development of my country's online finance has not only technical factors, but also institutional factors. my country's current social credit status is an important reason why most individuals and corporate customers take a wait-and-see attitude towards online banking and e-commerce.

(2) Liquidity risk. This means that network financial institutions do not have enough funds to meet the risk of customers cashing out electronic money. The size of the risk is related to the issuance scale and balance of electronic money. The larger the scale of the issuance, the larger the balance used for settlement, and the greater the possibility that the issuer cannot redeem the electronic currency issued by it or the clearing funds are insufficient. Because the current electronic currency is issued by the issuer on the premise of the existing value represented by the existing currency (current paper currency and other credit currency). It is an electronic and informationized transaction medium, and it is not an independent currency. After the trader receives the electronic money, the payment is not finally completed, and the actual money needs to be collected from the institution that issued the electronic money. Accordingly, the electronic money issuer needs to meet this liquidity requirement. When the issuer's actual currency reserves are insufficient, it will trigger a liquidity crisis. Liquidity risks can also be caused by the security factors of the network system. When the computer system and network communication fails, or the virus damage causes the payment system to fail to operate normally, it will inevitably affect the normal payment behavior and reduce the liquidity of the currency.

(3) Payment and settlement risks. Due to the virtual nature of online financial services, financial institutions’ business activities can break through the limitations of time and space and break the geographical restrictions of traditional financial branches and business outlets; simply opening online financial services may attract a considerable customer base and be able to Customers provide all-weather, all-round real-time services. Therefore, online finance is known as 3A finance (that is, it can provide services to customers at any time, any place, and in any way). Online financial operators or customers can handle securities investment, insurance, credit, futures trading and other financial services with any customer or financial institution in the world at any time through their respective computer terminals. This makes the network financial business environment have a great geographical openness, and leads to the internationalization of the payment and settlement systems in the network finance, thereby greatly increasing the settlement risk. There are a huge number of cross-border and cross-regional financial transactions based on electronic payment systems. In this way, the failure of a regional financial network will affect the normal operation and payment settlement of the national and even global financial networks, and will cause economic losses. In the 1980s, the U.S. Treasury Securities Trading System had a situation where only buying but not selling occurred, and debts of more than 20 billion U.S. dollars were formed overnight. Similar situations have occurred in our country.

(4) Legal risks. This is in response to the transaction risk caused by the relatively backward and obscure online financial legislation. The current financial legislative framework is mainly based on traditional financial services, such as banking law, securities law, financial disclosure system, etc. It lacks supporting regulations related to network finance. This is a common situation in many countries that develop network finance, and this is also true in my country. Internet finance is still in its infancy in my country, and corresponding regulations are still lacking. For example, there are no clear and complete laws and regulations in terms of access to the Internet financial market, identity authentication of traders, and confirmation of the validity of electronic contracts. Therefore, the use of the Internet to provide or receive financial services, the signing of economic contracts will face considerable legal risks in terms of rights and obligations, and easily fall into undue disputes. As a result, traders face The greater uncertainty of transaction behavior and its results increases the transaction costs of online finance and even affects the healthy development of online finance.

(5) Other risks. For example, market risk, that is, the impact of changes in market prices such as interest rates and exchange rates on the changes in the profit and loss of online financial traders' assets and liabilities, and the risks brought by financial derivative transactions, also exist in online finance.

Analysis of main risks

The risks faced by traditional banks, such as credit risk, liquidity risk, interest rate risk, and market risk, still exist in the operation of online banks, but in The manifestation has changed. What will be discussed here are the unique risks of online banking: operational risk, market risk, information risk, reputation risk and legal risk.

(1) Operational risk. Operational risk refers to the possibility of potential losses caused by major defects in system reliability, stability and safety. Operational risks may come from the negligence of online financial customers, or from design flaws and operational errors in the online financial security system and its products. Operational risks mainly involve the authorized use of online financial accounts, the risk management system of online finance, the exchange of information between other financial institutions and customers in online finance, and the identification of true and false electronic money. At present, the authorization management of online finance for access to financial institution accounts has become increasingly complicated. On the one hand, the processing power of computers has been enhanced, and on the other hand, the geographical location of customers has become more dispersed, which may also be due to the adoption of Caused by multiple communication methods and other factors.

(2) Transaction risk. Transaction risk refers to the fact that speculators use changes in market prices such as interest rates and exchange rates to conduct related transactions, which will adversely affect financial asset holders' changes in profit and loss. Due to the fast transmission of online information and the freedom from time and space constraints, online finance will amplify traditional financial risks, leading to sudden and more contagious occurrences of market price fluctuation risks, interest rate risks, and exchange rate risks, and greater harm. Financial networking has brought opportunities to speculators. They will conduct a large number of related transactions in the stock, foreign exchange, and futures markets, leading to ups and downs in the financial market, which may cause a fatal blow to a country's economy in a very short period of time. In today's financial network and globalization, the impact of international hot money on the securities market and the irrational operation of stock investors are the root of the turbulence of the securities market and the biggest potential risk of online finance.

(3) Information risk. Information risk refers to business risks caused by unfavorable choices and moral hazards faced by online banks due to information asymmetry or incomplete information. Due to the virtual nature of online finance, all financial transactions are carried out on the Internet through digitalization. In the online market, the information between commercial banks and customers is in a state of serious asymmetry, and customers will take advantage of information more than in traditional markets. , The formation of moral hazard actions that are detrimental to Internet banking.

(4) Reputation risk. Reputation risk refers to the risk that any party of an online financial trader cannot perform its obligations as agreed. Due to the virtual nature of online finance, compared with traditional finance, the importance of the physical structure and architecture of financial institutions is greatly reduced. The two parties in the transaction do not meet each other, but only contact each other through the network, which makes it more difficult to verify the identity of the trader and the authenticity of the transaction, and increases the information asymmetry between the traders in terms of identity confirmation and credit evaluation. Increased credit risk. For our country, the credit risk in online finance not only comes from the fictitiousness of service methods, but also the possibility of default caused by the imperfect social credit system. Reputational risks may come from huge losses in online finance, or when a security problem occurs in the payment system of online finance, it is difficult for the public to restore confidence in the ability of online financial transactions. Once the virtual financial service products provided by online finance cannot meet the expectations of the public and produce a wide range of adverse reactions in the society, the reputation risk of online finance will be formed. Or, if the security system of online finance has been damaged, whether the cause of such damage is internal or external, it will affect the public's business confidence in online finance.

(5) Legal risks. Legal risks stem from the possibility of violating laws and regulations, or the ambiguity of the legal rights and business of the parties involved in the transaction. Banks conduct business in other countries via the Internet, and may not have a good understanding of local regulations, which intensifies legal risks. Laws related to the Internet are still imperfect, such as the validity of electronic contracts and digital signatures, and the situation in different countries is different, which also increases the legal risks of Internet banking. At present, e-commerce and online finance are still in their infancy in many countries, and there is a lack of corresponding management rules and trial regulations for the protection of online consumers' rights and interests. Therefore, there are considerable legal risks in the use of the Internet and other electronic media to sign economic contracts.

Countermeasures and Suggestions

Countermeasures and Suggestions for Controlling Internet Financial Risks

my country’s Internet banks must have sufficiently strong security measures, otherwise Will affect the sustainable development of the financial industry. Network security assurance is a comprehensive and integrated system. Its planning and management requires the cooperation of relevant state departments, financial institutions, and IT circles to carry out scientific and strong intervention and guidance. At the same time, international cooperation should be carried out to jointly combat online finance. Crime.

(1) Speed up the legislative process of e-commerce and online banking. Generally speaking, network system security issues and the lag and ambiguity of network financial legislation are one of the causes of legal risks. In response to the current problems in online financial activities, speed up the pace of legal construction, promulgate laws and regulations related to online transactions and online banking as soon as possible, reduce the legal risks of banks, and regulate the behavior of online financial participants. E-commerce legislation must first address the legality of electronic transactions, how to access electronic evidence of transactions, whether the law recognizes such evidence, the behavioral norms of electronic money, electronic banking, and the legal issues of multinational banks. Secondly, the security and confidentiality of e-commerce must also be guaranteed by law, and there must be corresponding legal sanctions for computer crimes, computer leaks, theft of commercial and financial secrets, etc., so as to gradually form electronic products that are legally permitted, legally guaranteed and legally bound. Business environment. Third, make full use of policy measures to encourage online banking to develop business in a healthy development direction. Finally, to improve the credit level of the entire society, establish and improve my country's credit system.

(2) The China Banking Regulatory Commission should improve the level of supervision of online banking. Led by the China Banking Regulatory Commission, with participation of other banks, a unified set of norms and standards on online banking settlements and the use of electronic equipment will be formulated in order to achieve integration with the international financial industry; a complete set of online banking business approval and supervision mechanisms must be established. China’s national conditions, drawing on foreign development experience, set up a special institution to conduct research on the establishment, management, realization of specific business functions and the application of hardware and software systems for online banking, and provide technical services, support and guidance for the development of online banking, and use Internet and other advanced computer technologies are used for off-site supervision; security standards are selected for network banking security issues, and a security certification system is established; a set of effective program immunity systems are established for hacker programs and viruses; a financial information management analysis system is established And financial technology risk monitoring and early warning system; formulate rules and regulations related to the issuance, payment and management of digital electronic money.

(3) Vigorously develop advanced information technology with independent intellectual property rights, and establish a network security protection system. The security of network finance is ultimately realized and supported by the application of network technology. Its key technologies include firewall technology, data encryption technology and smart card technology, etc., mainly by adopting physical security strategies, access control strategies, building firewalls, and security interfaces. , Digital signature and other high-tech network technologies. In terms of hardware, most of the software and hardware systems such as computers and routers used in financial electronic business in my country are imported from abroad, and the information technology is relatively backward; in terms of software, my country’s current encryption technology and key Management technology and digital signature technology lag behind the requirements of the development of network finance, increasing the security risk and technology selection risk of the development of my country's network finance. Therefore, quickly narrowing the gap between hardware equipment and developed countries and developing information technology with independent intellectual property rights are fundamental measures to prevent and reduce security risks and technology selection risks, and to improve network security performance.

(4) Establish a large-scale shared online banking database. To protect the asset security of online banks, the problems of information asymmetry and information transparency must be resolved. Relying on database technology to store, manage, analyze and process data is the basic work that modern management must complete. The design of the online bank database should adopt the idea of socialized collaboration, and conduct the scientific management of assets, liabilities and intermediary business with the customer as the center. Different banks can implement the borrower credit information sharing system, and establish an early warning list of bad loans and "black". List” system. For enterprises or enterprise groups that have a certain proportion of asset control relationships, business control relationships, and personnel relationships, use the database to classify, analyze, and count, and uniformly monitor the credit.

(5) Establish a unified technical standard for online finance. At present, the electronic construction of my country's financial system has problems such as inconsistent planning, inconsistent technical standards for commercial banks, inconsistent technical specifications, and different security protocols used between commercial banks. A unified technical standard for the financial industry should be formulated. The establishment of the China Financial Certification Center laid the foundation for this. The establishment of a unified development plan and technical standards is conducive to unified supervision, enhance coordination within the network financial system, reduce payment and settlement risks, and facilitate the monitoring of other risks. We must become familiar with and master the international standards and norms related to computer network security as soon as possible, such as mastering and applying the international ISO security system structure for banking transaction systems, etc., and formulate a relatively complete set of international standards so that my country’s network banks can prevent risks. In line with international standards.

(6) Strengthen the research, development and utilization of financial innovation. my country's research on financial innovation, especially its application, is still at a relatively low level. Many financial derivatives have not been used yet. The academic and practical circles should jointly tackle key problems and continue to create, design, and develop various new portfolio finances. Tools, so that the innovation and risk control of financial derivatives in my country can be strengthened, in order to obtain the best return within a certain degree of risk.