ItemRegulations

Classificationofcheckrecords

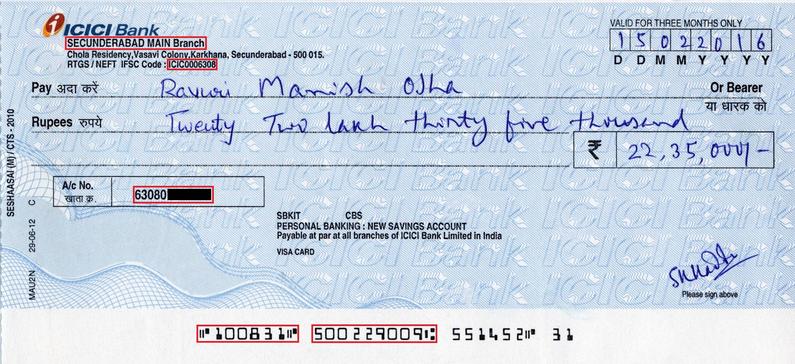

Checkrecordsinclude:absoluterecords,relativerecords,andnon-statutoryrecords.mycountry's"NegotiableInstrumentsLaw"and"PaymentandSettlementMeasures"stipulatethattwoabsoluterecordscanberecordedbytheissuerintheformofauthorizedsupplementaryrecording,including:theamountofthecheckandthenameofthepayee.Notethatitcannotbeusedbeforethesupplementaryrecordingismade.

(1)Absoluterecords:①Indicatethewords"check";②Unconditionalpaymentcommission;③Confirmedamount;④Nameofpayer;⑤Dateofissue;⑥Signatureandsealofissuer.ItisarequiredentryrequiredbytheNegotiableInstrumentsAct.Ifacertainentryismissing,theinvoicewillbeinvalid.

(2)Relativerecords:①Theplaceofpayment(iftheplaceofpaymentisnotrecordedonthecheck,theplaceofpaymentisthebusinessplaceofthepayer)②Theplaceofissue(wheretheplaceofissueisnotrecordedonthecheck),Thenthebusinessplace,residence,andhabitualresidenceoftheissuershallbetheplaceofissue).Itmeansthatthenegotiableinstrumentlawrequiresthatitshouldberecordedbutnotrecorded.Ifitisnotrecorded,itcanbepresumedthroughlegalprovisionswithoutcausingthenegotiableinstrumenttobeinvalid.

(3)Non-statutoryrecords:①thepurposeofthecheck;②thecontractnumber;③theagreedliquidateddamages;④thecompetentcourt,etc.Non-statutoryrecordsdonothavetheeffectonthecheck.

Features

1.Easytouse,simpleandflexibleprocedures;

2.Thepaymentdeadlineforthecheckisfromthedateofissue10daysfromthebeginning;

3.Chequescanbeendorsedandtransferred,butchecksusedforcashwithdrawalcannotbeendorsedandtransferred.

Classification

Registeredcheque

(Chequepayabletoorder)isinthepayablecolumnofthecheque,indicatingthereceiptThenameofthepayee,suchas"Limitedpayment(PayAOnly)"(PayAOnly)or"SpecifiedPerson"(PayAOrder),mustbesignedandsealedbythepayeebeforewithdrawalcanbemade.

Bearercheque

(Chequepayabletobearer)isalsoknownasablankcheque.Thepayee’snameisnotrecordedonthecheque,andonly"Payabletobearer"iswrittenonthecheque."(Paybearer).Whenwithdrawingmoney,theholderdoesnotneedtosignonthebackofthecheckinordertowithdrawit.Thischeckisonlytransferablebydelivery.

CrossedCheque

(CrossedCheque)isacheckwithtwoparallellinesdrawnonthefrontofthecheque.Crossedchequesaredifferentfromordinarychecks.Crossedchequesarenotallowedtobecollectedbythebank,sothebankcanonlyentrustthebanktocollectthepaymentandenteritintotheaccount.Thepurposeofusingacrossedcheckistorecoverthepaymentthroughcluescollectedbythebankwhenthecheckislostorfraudulentlycollected.

CertifiedCheque

(CertifiedCheque)meanstopreventthedrawerfromissuingabadcheck,toensurepaymentwhenthecheckispresented,andthereceiptofthecheckThepersonortheholdermayrequestthebankto"guarantee"thecheck.Guaranteedpaymentiswhenthepayingbankaffixesa"guaranteed"stamponthechecktoindicatethatthepaymentmustbemadewhenthecheckispresented.Oncethechequeisguaranteedandpaid,thepaymentresponsibilityisbornebythebank.Boththedrawerandendorserareexemptfromrecourse.Afterthepayingbankguaranteesthepaymentofthecheck,itwilltransferthepaymentfromtheissuer'saccounttoaspecialaccountforpayment.Therefore,whentheguaranteedcheckispresented,itwillnotberefunded.

CashCheque

(cashCheque)isakindofchequespeciallymadetowithdrawcash.Whencustomersneedtousecash,theycansigncashchecksatanytimeandwithdrawcashfromthebankthatholdstheaccount.Thebankwillunconditionallypaythepayeeacashbillofacertainamountwhentheticketisseen.

Bankcheque

(Banker’sCheque)isachequeissuedbyabankandpaidbythebank.Itisalsoabankdraftatsight.Bankscanwritebankcheckswhenhandlingdraftremittancesonbehalfofcustomers.

Traveller’sCheque

(Traveller’sCheque)isafixed-amountpaymenttoolissuedbyabankortravelagencyfortourists.Ameansofpaymentforinstitutionstopurchasewithcash.

Comparedwithotherchecks,traveler’scheckshavethefollowingcharacteristics:

①Theamountisrelativelysmall.

②Thereisnodesignatedpayerandpaymentplace.Youcanwithdrawmoneyattheforeignbranchoftheissuingbank,travelagencyoragencypoint.

③Itissafer.Whenpurchasingtraveler’schequesandwithdrawingmoney,travelersmustgothroughtheinitialsigningandre-signingprocedures,andthetwomustmatchbeforewithdrawing.

④Thesenderisalsothepayee.Othercheckscanonlybeissuedbydepositinginabank,andtraveler'schecksarepurchasedwithcash,similartobankdrafts,exceptthatthesenderoftraveler'schecksisalsothepayee.

⑤Thecirculationperiodisnotspecified.Sincetheissuanceoftraveler’schecksrequiresahandlingfee,andtheoccupiedfundsdonothavetopayinterest,itisprofitable.Therefore,variousbanksandtravelagenciesarecompetingtoissuetraveler’schecks.

Applyfor

1.Toopenacheckingdepositaccount,theapplicantmustusehisorherrealnameandsubmitalegaldocumenttoprovehisidentity;

2.OpenForcheckingdepositaccounts,applicantsshouldreservetheirownsignaturestyleandseal;

3.Toopencheckdepositaccountsandreceivechecks,theyshouldhavereliablecreditanddepositacertainamountoffunds.

Use

1.Transfercheckscanbeendorsedandtransferred;cashcheckscannotbeendorsedandtransferred.

2.Thecheckreminderpaymentperiodistendays(fromthedaythecheckisissued,theduedatewillbepostponedincaseofofficialholidays).

3.Thedateofissuanceofthecheck,thecapitalizationamountandthenameofthepayeeshallnotbechanged.Ifothercontentiswrong,itcanbecorrectedbycrossingalineandaffixedwithoneofthereservedbankseals.

4.Ifthecheckislost,youcanapplytothepayingbanktoreportthelossandstoppayment;thebankwillnotacceptthepaymentifthepaymenthasbeenmadebeforethelossisreported.

5.Theissuerissuesablankcheck,acheckwhosesealdoesnotmatchthebank'sreservedseal.Inadditiontorefundingthecheck,thebankwillalsocharge5%ofthefaceamountbutnotlessthan1,000yuanfine.Theholderhastherighttorequestthedrawertocompensate2%ofthecheckamount.

*6,"PaymentandSettlementMeasures"ofthePeople'sBankofChina(Yinfa[1997]No.393)"Article125Theissuerissuesablankcheck,andacheckwhosesealdoesnotmatchthebank'sreservedseal,Usethepaymentpasswordarea,paythecheckwiththewrongpassword,thebankshallrefundtheticketandimposeafineof5%butnotlessthan1,000yuanonthefaceamount;theholderhastherighttoaskthedrawertocompensate2%ofthecheckamount..Forrepeatedissuance,thebankshallstoptheissuanceofchecks.""NoticeofthePeople'sBankofChinaonIssuesConcerningAdministrativePenaltiesforIssuingBadCheques"(Yinfa[2005]No.114)"Part(1)QualificationsofSubjectstoImposePenalties:Inaccordancewiththerelevantprovisionsofthe"AdministrativePunishmentLawofthePeople'sRepublicofChina"andthe"MeasuresfortheImplementationofBillManagement",thePeople'sBankofChinaanditsbranchesshallimplementtheissueofbadcheques,andtheissuersofchequeswhosesignaturesandsealsdonotmatchthereservedbankaccounts.Administrativepenalties.Articles125and239ofthe"PaymentandSettlementMeasures"shallbesuspended."

Scopeofapplication

AllpaymentsbetweenunitsandindividualsinthesamecitybillexchangeareaCheckscanbeusedforsettlement.SinceJune25,2007,chequeshavebeenadoptednationwide,andchequescanalsobeusedforpaymentandsettlementbetweendifferentcities.

Applicationprocedures

1.Toopenacheckingdepositaccount,theapplicantmustusehisorherrealnameandsubmitalegaldocumenttoprovehisidentity;

2,openToopenacheckdepositaccount,theapplicantshouldreservehisownsignatureandseal;

3.Toopenacheckdepositaccountandreceiveacheck,theapplicantshouldhaveareliablecreditanddepositacertainamountoffunds.

Reporttheloss

Commonchequesandcashchequesthathavebeenissued.Ifitislostduetoloss,theft,etc.,youshouldimmediatelyapplytothebanktoreporttheloss.

(1)Iftheissuerlosesorstolenacheckthatcanbedirectlywithdrawnincash,etc.,itshouldissueanofficialletterorrelevantcertification,andfillinthetwo-partlossreportapplicationform(youcanreplaceitwithanincomingbill),stampthesignatureandsealofthereservedbank,andapplytothebankthatopenedtheaccounttoreportthelossandstoppayment.Thebankfindsthatthecheckhasnotbeenpaid,andacceptsthereportofthelossafterchargingacertainlossreportingfee,andusesaredpentoindicatethechecknumberandthedateofthelossreportintheaccountofthepersonwhoreportedtheloss.

(2)Thepayeeshallalsoissueanofficialletterorrelevantcertificationforthelossortheftofthechequeacceptedfordirectcashwithdrawal,andfillinthetwocopiesoftheapplicationforreportinglossandstoppayment,signedbythepayerAfterproof,applytothepayee'sbanktoreportthelossandstoppayment.Otherrelevantproceduresarethesameasabove.Atthesametime,accordingtoArticle15paragraph3ofthe"NegotiableInstrumentsLaw":"Thepersonwholosestheticketshall,within3monthsafterthenotificationofthelossreportandstoppayment,orafterthelossoftheinstrument,applytothepeople’scourtforpublicnotice,orfilearequestwiththepeople’scourt.Litigation."Thatis,whenthebillisstolen,lost,ordestroyed,theholderofthenegotiablebillthatcanbeendorsedmustapplyinwritingtothebasicpeople'scourtwherethebillispaid(thatis,theplaceofpayment).Intheapplicationformsubmittedbythepersonwholostthetickettothepeople’scourt,themaincontentoftheticket,includingthetypeoftheticket,theamountoftheticket,thedrawer,thepayer,andtheendorser,shouldbestated,andthecircumstancesofthelossoftheticketshouldbestated.Atthesametime,relevantevidenceshouldbepresentedtoproveTheholderofthenegotiableinstrumentthatheisindeedtheloserhastherighttoapply.

Beforethepersonwholosttheticketreportedthelosstothepayer,orbeforethepersonwholosttheticketappliedforpublicreminder,ifthebillhasbeenpaidingoodfaithbythepayer,thepersonwholosttheticketshallnotapplyforpublicremindertomakepaymentagain.Thebankisnolongerliableforpayment.Thelosscausedtotherightholderofthecheckshallbebornebythepersonwholostthecheck.

Accordingtoregulations,thetransfercheckthathasbeenissuedislostorstolen.Sincethischeckcanbeusedtopurchasegoodsdirectly,thebankdoesnotacceptlossreporting.Therefore,thepersonwholosestheticketcannotapplytothebanktoreportthelossorstoppayment.Butyoucanaskthepayeeandthebankthatholdstheaccounttohelppreventit.Ifthelostcheckexceedsthevalidityperiodorthepayingbankhaspaidforthecheckbeforereportingtheloss,alllossescausedbythisshallbebornebythepersonwholostthecheck.

Mattersneedingattention

Whetheritcanbeusedforpayment

ThecheckisissuedbythedrawerandentrustedtothebankorotherbankthathandlesthedepositbusinessAfinancialinstitutionunconditionallypaysacertainamountofabilltothepayeeortheholderwhenthebillisseen.Thereare3typesofchecks,ordinarychecks,cashchecks,andtransferchecks.Acashcheckcanonlybeusedtowithdrawcash.Itcanbeissuedbythedepositorandusedtowithdrawcashfromthebankfortheunit,oritcanbeissuedtootherunitsandindividualsforsettlementorentrustthebanktopaycashtothebeneficiary;transfercheckItcanonlybeusedfortransfers.Itissuitablefordepositorstotransferfundstobeneficiarieswithinthesamecitytohandlecommoditytransactions,laborsupply,debtrepaymentandothersettlementsettlements;ordinarycheckscanbeusedtowithdrawcashorcanUsedfortransfers.However,thetwoparallellinesdrawnontheupperleftcornerofanormalcheckarecrossedchecks,whichcanonlybeusedfortransfersandcannotbewithdrawnincash.

Tosumup,thecharacteristicsofchecksettlementaresimple,flexible,fastandreliable.Theso-calledsimple,itreferstothesimpleandconvenientsettlementproceduresusingcheques.Aslongasthepayerhasenoughdepositsinthebank,itcanissueachequetothepayee,andthebankcanhandlethetransferofmoneyorcashpaymentwiththecheque.Theso-calledflexiblemeansthataccordingtoregulations,thecheckcanbeissuedbythepayertothepayeefordirectsettlement,orthepayercanissuetheinvoiceandentrustthebanktoactivelypaythepayee.Inaddition,thetransfercheckcanalsobeendorsedinthedesignatedcity.transfer.Theso-calledspeedyreferstotheuseofchequesforsettlement.Thepayeesendsthetransferchequeandthepaymentsliptothebank,whichcangenerallybecreditedonthesamedayorthenextday,andcashcanbeobtainedatthetimewhenacashchequeisused.Theso-calledreliabilitymeansthatbanksarestrictlyprohibitedfromissuingbadchecks.Eachunitmustbewithinthebalanceofbankdepositstoissuechecks.Therefore,thepayeecanobtainthemoneywiththecheck.Generally,thereisnonormalpaymentfailure.

Fillinstyleandformat

Commonchecksaredividedintocashchecksandtransferchecks.Itisclearlymarkedonthefrontofthecheck.Cashcheckscanonlybeusedtowithdrawcash(onlywithinthesamecity);transfercheckscanonlybeusedfortransfers(onlywithinthesamecity,includingYuhangandXiaoshan).

Fillinginthecheck:

1.Ticketissuancedate(uppercase):Numbersmustbeinuppercase,uppercasenumbersarewritten:zero,One,Two,Three,Four,Five,Lu,Seven,Ba,Jiu,Shi.Forexample:August5th,2005:Twoandzerofiveyears,fivemonthsandfivedays.

Whenfillinginthemonthandday,themonthisone,twoandoneten,andthedayisonetonineandone.Forpick,twoandthree,"zero"shouldbeaddedinfrontofit;fordaysfromonetotennines,"one"shouldbeaddedinfrontofit.Forexample,February12thshouldbewrittenaszerotwomonthsandonetenthday:October20thshouldbewrittenaszeroonetenthmonthandtwodays.

2,Payee:

(1)CashchequepayeecanWritethenameoftheunit.Atthistime,thefinancialsealandlegalpersonsealoftheunitwillbestampedinthecolumnof"endorsedperson"onthebackofthecashcheck.Afterthat,thepayeecandirectlywithdrawcashatthebankwheretheaccountisopenedbypresentingthecashcheck.(Becausesomebanksareconnectedtothenetwork,theycanalsowithdrawmoneyatthenetworkedbusinesspoints,dependingonthecoverageofthenetwork).

(2)Thepayeeofthecashcheckcanbewrittenasthepersonalnameofthepayee.Atthistime,thereisnosealonthebackofthecashcheck.ThepayeeshouldfillintheIDnumberandissuingauthorityonthebackofthecashcheckName,signandcollectpaymentwithIDcardandcashcheck.

(3)Thepayeeofthetransfercheckshouldbethenameoftheotherparty’sunit.Thecompanydoesnotstampthebackofthetransfercheque.Afterreceivingthetransfercheck,thepayeeshallaffixthespecialfinancialsealandlegalpersonsealofthepayeeintheendorsedcolumnonthebackofthecheck,fillinthebankstatementandsubmitthechecktotheaccountopeningbankofthepayeetoentrustthebankforcollection.

3.Thenameofthepayingbankandtheaccountnumberofthedrawer:thenameofthebankthatopenedtheaccountandthebankaccountnumberoftheunit,theaccountnumberinlowercase.

4.Renminbi(uppercase):Capitalizationofnumbers:zero,one,two,three,four,five,lu,seven,p,nine,ten,hundred,thousand,Trillion,billion.Checkfillingstyleandformat.

Note:"10,000"isnotaccompaniedbyasingleperson.

Forexample:(1)289,546.52twohundredandtenthousandfivehundredandtenthousandfivehundredandfivehundredandsixpoints.

(2)7,560.31SeventhousandfivehundredLuShiyuanzerotriangleandoneminute

Atthistime,"LuShiyuanzerotriangleandoneminute"and"zero"canbewrittenornotWrite

(3)532.00FivehundredandthreehundredandtwoYuanzheng

Itisalsopossibletowrite"zheng"as"whole".Itcannotbewrittenas"zeroangleandzeropoints"

(4)425.03fourhundredtwentyfiveyuanzerothreepoints

(5)325.20threehundredtwentyfiveyuantwoangle.

Theword"positive"canbeaddedafterthecornercharacter,but"zeropoints"cannotbewritten,whichismorespecial.

5.LowercaseRMB:Thefirstblankboxofthehighestamountisdeletedwiththeprefix"¥",andthenumberisrequiredtobecompleteandclear.

6.Purpose:

(1)Therearecertainrestrictionsoncashchecks,generallyfillin"backupfunds","travelexpenses","salary","Laborservicefees"etc.

(2)Therearenospecificrulesfortransferchecks,suchas"payment","agentfee"andsoon.

7.Stamp:

Thefrontofthecheckisstampedwithaspecialfinancialsealandacorporateseal.Bothareindispensable.Theinkpadisred.ThesealmustbeclearandfuzzyYoucanonlyinvalidatethischeck,replaceitwithanewone,fillinandre-stampit.See"2.Payee"forwhetherthereversesideisstampedornot.

8.Payment:

1.Fillinthebill,intriplicate.

2.Therearetwowaystosendthetransferchecktothebank:

(1)Tothepayee’sbank,thepayeeneedstobestampedandendorsed,andthecheckisintheendorsementcolumnFillintheaccountbankofthepayee,andwriteentrustedcollectioninthebottomcolumn.Andputthesealreservedbythebankintheendorsementframe,thatis,thespecialfinancialsealandthecorporateseal.

(2)Ifyouareworriedthattheotherpartyisissuingabadcheck,youcanalsogotothepayer’sbanktodepositthecheck.Inthiscase,thecheckdoesnotneedtobeendorsed.

3.Thecashcheckisdirectlydeliveredtotheissuingbankoftheissuer,andthepayeemustendorseit.Ifitisaunit,stampthepayee’sfinancialsealandacorporatesealonthebackofthecheck,ifitisanindividual,FillintheIDnumber,theissuingauthority,andsign.

9.Commonsense:

(1)Theremustbenotracesofalterationonthefrontofthecheck,otherwisethecheckwillbeinvalid.

(2)Ifthepayeefindsthatthecheckisincomplete,hecanmakeasupplement,butitcannotbealtered.

(3)Thevalidityperiodofthecheckis10days,andthebeginningandtheendofthedatearecountedasoneday.Holidaysarepostponed.

(4)Checksarepayableonsight,anonymous.(Lostcheques,especiallycashcheques,maybetheamountofmoneylost,andthebankisnotresponsible.Cashchequesgenerallyhavealltheelementsfilledin.Ifthechequeisnotfraudulentlycollected,reportthelossatthebankwheretheaccountwasopened;ifthetransferchequehasalltheelementsfilledin,Reportthelossatthebankwheretheaccountwasopened.Iftheelementsarenotfilledincompletely,reportthelosstotheclearinghouse.)

(5)Thestamponthebackofthecashcheckfromtheissuingunitisblurred.Youcancrosstheblurredstampandre-sealit.Onetime,butnomorethanthreeseals.

(6)Thesealonthebackofthetransfercheckofthepayeeunitisblurred(atthistime,thebilllawstipulatesthatthere-sealmethodcannotbeusedtoremedyit),andthepayeeunitcanbringthetransfercheckandbankstatementGotothebankoftheissuingunittogothroughthecollectionprocedures(withoutpayingthehandlingfee),commonlyknownas"flip",soyoudon'tneedtogototheissuingunittore-writethecheck.

(7)Drawtwoslashesintheupperleftcornerofthechecktopreventthecheckfrombeingwithdrawnafteritislost,thatis,itcanonlybedonebybanktransfer.

Cashcheque

Whenthedrawer'saccountopeningbankreceivescashfromthepayeewithacashcheque(Appendix15),itshouldcarefullyreview:

(1)Whetherthecheckisauniformlyprintedvoucher,whetherthecheckistrue,andwhetherthepaymentdeadlineisexceeded;

(2)WhetherthenameofthepayeefilledinthecheckisThepayee,whetherthepayeesignsthe"Payee'sSignature"onthebackofthecheck,andwhetheritssignatureisconsistentwiththepayee'sname;

(3)Drawer'ssignatureWhetheritmeetstheregulations,andcheckwhetherthesignatureandthereservedbanksignatureareconsistentwiththecorners.Ifthepaymentpasswordisused,whetherthepasswordiscorrect;

(4)Whethertheupperandlowercaseamountofthecheckisconsistent;

(5)Whethertheitemsthatmustberecordedinthecheckarecomplete,whethertheamountoftheticketisissued,thedateoftheticket,andthenameofthepayeehavebeenchanged,andwhetherthechangeofotherrecordeditemsiscertifiedbytheoriginalrecorder'ssignature;

(6)Whetherthereisenoughpaymentinthedrawer’saccount;

(7)Whetherthecashwithdrawnmeetsthenationalcashmanagementregulations.

Ifthebeneficiaryisanindividual,theidentitydocumentshouldalsobereviewed,andwhetherthename,numberandissuingauthorityoftheidentitydocumentshouldbeindicatedonthebackofthechequeinthe"signatureofthebeneficiary".Aftertheexaminationiscorrect,abronzemedaloramatchingslipwillbeissued,andthepayeecanwithdrawthemoneyfromthecashier.Atthesametime,paymentismadefromtheaccountofthedrawer,andthecheckissenttothecashierforpaymentasadebitvoucher.Theentryis:

(debit)××subjectdraweraccount

(credit)cash

Processingproceduresforcrossedchecks

Thehandlingproceduresforthecrossedcheque(attachment16)bytheholderandtheissuingbank’saccountshallbehandledinaccordancewiththeproceduresin1.

Processingproceduresofordinarycheques

Ifthedrawer'saccountopeningbankreceivesthepayeewithordinarycheques(attachmentsixteen)towithdrawcash,followtheproceduresin2.

Forthetransferofordinarychecks,pleasefollowtheproceduresin1.

Differenceswithpromissorynotes

Similarities

1,havethesameNature

(1)areallequitysecurities.Thatistosay,theholderofthebillusesthecontentoftherightsrecordedonthebilltoprovetherightsofthebillinordertoobtainproperty.

(2)areallformatsecurities.Theformatofthebill(itsformandrecordeditems)isstrictlyregulatedbythelaw(ie,theNegotiableInstrumentLaw),andnon-compliancewiththeformathasacertainimpactontheeffectivenessofthebill.

(3)arealltextsecurities.Thecontentofthebillrightsandallmattersrelatedtothebillshallbesubjecttothewordsrecordedonthebill,andshallnotbeaffectedbymattersotherthanthewordsonthebill.

(4)Allsecuritiesaretradableandtransferable.Theclaimsofgeneraldebtcontracts.Ifyouwanttotransfer,youmustobtainthedebtor'sconsent.Andasabillofnegotiablesecurities.Itcanbefreelytransferredandcirculatedthroughthesimpleprocedureofendorsementordeliveryofbillswithoutendorsement.

(5)arealluncausedsecurities.Thatistosay,theexistenceoftherightsonthebillisonlydeterminedbythetextonthebillitself,andtherightholderenjoystherightsofthebillonlyifitisnecessarytoholdthebill.Asforthereasonwhytheobligeeobtainsthebill,thereasonfortheoccurrenceofthebillrightcanbeignored.Whetherthesereasonsexistornot,whethertheyareeffectiveornot,doesnotaffecteachotherinprinciplewiththerightsofthebill.Becauseourcountry'sbillsarenotcompletelybillsinthesenseofbilllaw.It'sjustthewayofbanksettlement,thiskindofnon-causeisnotabsolute.

2,havethesamebillfunction

(1)exchangefunction.Relyingonthisfunctionofbills,thespaceobstacleofcashpaymentbetweenthetwoplacesissolved.

(2)Creditfunction.Theuseofbillscansolvethetimebarrierofcashpayment.Thebillitselfisnotacommodity,itisawrittenpaymentvoucherbasedoncredit.

(3)Paymentfunction.Theuseofbillscansolvethetroubleofcashpaymentprocedures.Billscanbetransferredmultipletimesthroughendorsementsandbecomeacirculationandpaymenttoolinthemarket,reducingtheuseofcash.Moreover,duetothedevelopmentofthebillexchangesystem,billscanbeclearedcentrallythroughtheclearingcenter,simplifyingsettlementprocedures,speedingupcapitalturnover,andimprovingtheefficiencyofsocialcapitaluse.

Differentpoints

(1)Promissorynotesareagreed(appointedtopaybyoneself)securities;billsofexchangeareentrusted(entrustedtopaybyothers)securities;chequesareentrustedPaymentofsecurities,butthetrusteeislimitedtobanksorotherstatutoryfinancialinstitutions.

(2)mycountry'sbillsaredifferentintheareasofuse.Promissorynotesareonlyusedforthesettlementofcommoditytransactions,laborsuppliesandotherpaymentswithinthesamecity;chequescanbeusedinthesamecityorinclearingareas;moneyorderscanbeusedinthesamecityandindifferentplaces.

(3)Thepaymenttermisdifferent.Thepaymenttermofthepromissorynoteisonemonth,andthebankwillnotacceptitifitisoverdue;thebillofexchangeinmycountrymustbeaccepted,therefore,theholdercannotredeemitwhentheacceptanceisdue.Whenthepayer’saccountontheduedateofthecommercialacceptancebillisinsufficienttopay,thebankthatholdstheaccountshallreturnthecommercialacceptancebilltothepayeeortheendorsed,anditshallhandleitbyitself.Bankacceptancebillsarepaidonthematuritydate,butiftheacceptancematuritydatehaspassedandtheholderdoesnotrequireredemption,the"BankSettlementMeasures"doesnotprovideforhowtodealwithit.Eachbankhasmadesomesupplementaryregulationsonitsown.IftheICBCstipulatesthattheholderdoesnotrequireredemptionwithinonemonthoftheacceptancedate,theacceptanceshallbecomeinvalid.Thecheckpaymentperiodis5days(thepaymentperiodofthetransfercheckintheendorsementtransferareais10days.Fromthedayaftertheissuance,theduedatewillbepostponedduetothecustomaryholiday).

(4)Moneyordersandcheckshavethreebasicparties,namelythedrawer,thepayer,andthepayee;whilethepromissorynotehasonlythedrawer(thepayerandthedrawerarethesameperson)andthepayeePeoplearetwobasicparties.

(5)Theissuerofthecheckmusthaveafinancialrelationshipwiththepayerbeforethecheckcanbeissued;theissuerofthebillofexchangedoesnothavetohaveafinancialrelationshipwiththepayer;theissuerofthepromissorynoteTheticketholderandthepayerarethesameperson,andthereisnoso-calledfinancialrelationship.

(6)Theprincipaldebtorofchecksandpromissorynotesisthedrawer,whiletheprincipaldebtorofthebillofexchangeisthedrawerbeforeacceptanceandtheacceptorafteracceptance.

(7)Forwarddraftsneedtobeaccepted,chequesgenerallydonotneedtobeacceptedatsight,andpromissorynotesdonotneedtobeaccepted.

(8)Thedrawerofthebillofexchangeguaranteestheacceptancepayment.Ifthereisanotheracceptor,theacceptorwillguaranteethepayment;thedrawerofthecheckguaranteesthepaymentofthecheck;thedrawerofthepromissorynoteisresponsibleforthepayment.

(9)Holdersofchequesandpromissorynotesonlyhavetherightofrecourseagainstthedrawer,whileholdersofbillsofexchangehavetherightofrecourseagainstthedrawer,endorser,andacceptorduringthevalidityperiodofthebill.Thereisrecourse.

(10)Thereisacopyofthemoneyorder,butthereisnopromissorynoteandcheque.

Commonphrases

chequebook

chequedrawer

chequeholder

Bearerchequechequetobearer/bearercheque

Bearercheque/bearerchequechequetoorder

Antedatedcheque

Unexpiredchequepostdatedcheque

certifiedcheque

returnedcheque

crossedcheque

normalcrossLinegeneralcrossing

specialcrossing

blankcheque

stalecheque

normalchequeopencheque

Achequefor$10,000,less10%discount

Achequefor$10,000,less10%discount

Achequefor$10,000witha10%discount,(11,000yuan)achequefor$10,000,plus10%charges

tocashacheque

toclearacheque

Guaranteedcashingtocertifyacheque

Tofillupacheque

tocrossacheque

Developachequetomakeoutacheque

todrawacheque/toissueacheque

tooverdrawacheque

toendorseacheque

topayacheque/tohonouracheque

todishonouracheque

torefuseacheque

tostoppaymentofacheque

topresentforpayment

payabletobearer

Payabletoorder

outofdate/stale

PleasegiveR/D/refertodrawer

InsufficientdepositN/S/NSF/notsufficientfunds/I/F/insufficientfunds

Wordsandfiguresdiffer

Thecheckexchangetimehaspassedaccountclosed

Thechangeshouldbestampedwiththesealalterationsrequireinitials

effectsnotcleared

paymentstopped

chequemutilated

Legalstatement

ChinaTherelevantlegalprovisionsonchecksintheNegotiableInstrumentsLawareasfollows:

Article82ChecksareissuedbythedrawerandareentrustedThebankorotherfinancialinstitutionthathandlesthecheckdepositbusinessunconditionallypaysacertainamounttothepayeeorthenoteholderwhenthenoteisseen.

Article83Toopenacheckingdepositaccount,theapplicantmustusehisorherrealnameandsubmitalegalcertificatetoprovehisidentity.

Toopenacheckdepositaccountandreceivechecks,youshouldhaveareliablecreditanddepositacertainamountoffunds.

Toopenacheckingdepositaccount,theapplicantshouldreservethesignatureandsealofhisrealname.

Article84Chequescanbewithdrawnincashortransferred.Whenusedfortransfer,itshouldbeindicatedonthefrontofthecheck.

Ifacheckisspecificallyusedforcashwithdrawal,acashcheckcanbemadeseparately,andacashcheckcanonlybeusedforcashwithdrawal.

Ifthecheckisspecificallyusedfortransfer,youcanmakeaseparatetransfercheck.Thetransfercheckcanonlybeusedfortransfer,andnocashcanbewithdrawn.

Article85chequesmustrecordthefollowingitems:

(1)Indicatethewords"check";

(2)Entrustmentofunconditionalpayment;

(3)Thedeterminedamount;

(4)Thenameofthepayer;

(5)Thedateofissuance;

(6)Signatureandsealofthedrawer;

(7)The12-digitbankinginstitutioncodemustberecordedinthelowerrightcornerofthecheckinadifferentplace,and6inthesamecity.

Ifoneoftheitemsspecifiedintheprecedingparagraphisnotrecordedonthecheck,thecheckisinvalid.

Article86Theamountonthecheckcanbeaddedupontheauthorizationofthedrawer.Thecheckbeforeithasnotbeenaddedshallnotbeused.

Article87Ifthepayee'snameisnotrecordedonthecheck,itmaybeaddedwiththeauthorizationofthedrawer.

Iftheplaceofpaymentisnotrecordedonthecheck,thebusinessplaceofthepayershallbetheplaceofpayment.

Iftheplaceofissueisnotrecordedonthecheck,thebusinessplace,residenceorhabitualresidenceofthedrawershallbetheplaceofissue.

Thedrawercanrecordhimselfasthepayeeonthecheck.

Article88Theamountofthecheckissuedbythedrawerofthecheckshallnotexceedtheactualamountofdepositinthepayeratthetimeofpayment.

Iftheamountofthecheckissuedbythedrawerexceedstheamountactuallydepositedatthepayeratthetimeofpayment,itisabadcheck.Itisforbiddentoissuebadchecks.

Article89Theissuerofacheckshallnotissueacheckthatdoesnotmatchthesignatureorsealofhisreservedrealname.

Article90Thedrawermustberesponsibleforguaranteeingpaymenttotheholderinaccordancewiththeamountofthecheckissued.

Whenthedrawer’sdepositatthepayerissufficienttopaythecheckamount,thepayershallpayinfullonthesameday.

Article91Checksarelimitedtopayatsight,andthepaymentdateshallnotberecordedseparately.Ifthepaymentdateisrecordedseparately,therecordisinvalid.

Article92Theholderofacheckshallpresentforpaymentwithin10daysfromthedateofissuance;foracheckusedinadifferentplace,thetimelimitforpresentingpaymentshallbeseparatelystipulatedbythePeople’sBankofChina.

Thepayermaynotmakethepaymentifthedeadlineforpaymentisexceeded;ifthepayerdoesnotmakethepayment,thedrawershallstillbeliableforthebilltotheholder.

Article93Ifthepayerpaystheamountofthecheckinaccordancewiththelaw,heshallnolongerbeliableforentrustedpaymenttothedrawer,andshallnolongerbeliableforpaymenttotheholder.However,thepayerdoesnotpayinbadfaithorgrossnegligence.

Article94Inadditiontotheprovisionsofthischapter,theendorsementofchecks,paymentbehavior,andtheexerciseoftherightofrecourseshallbegovernedbytheprovisionsofChapter2ofthislawondrafts.

Inadditiontotheprovisionsofthischapter,theissuanceofchecksshallbegovernedbytheprovisionsofArticle24andArticle26ofthislawondrafts.